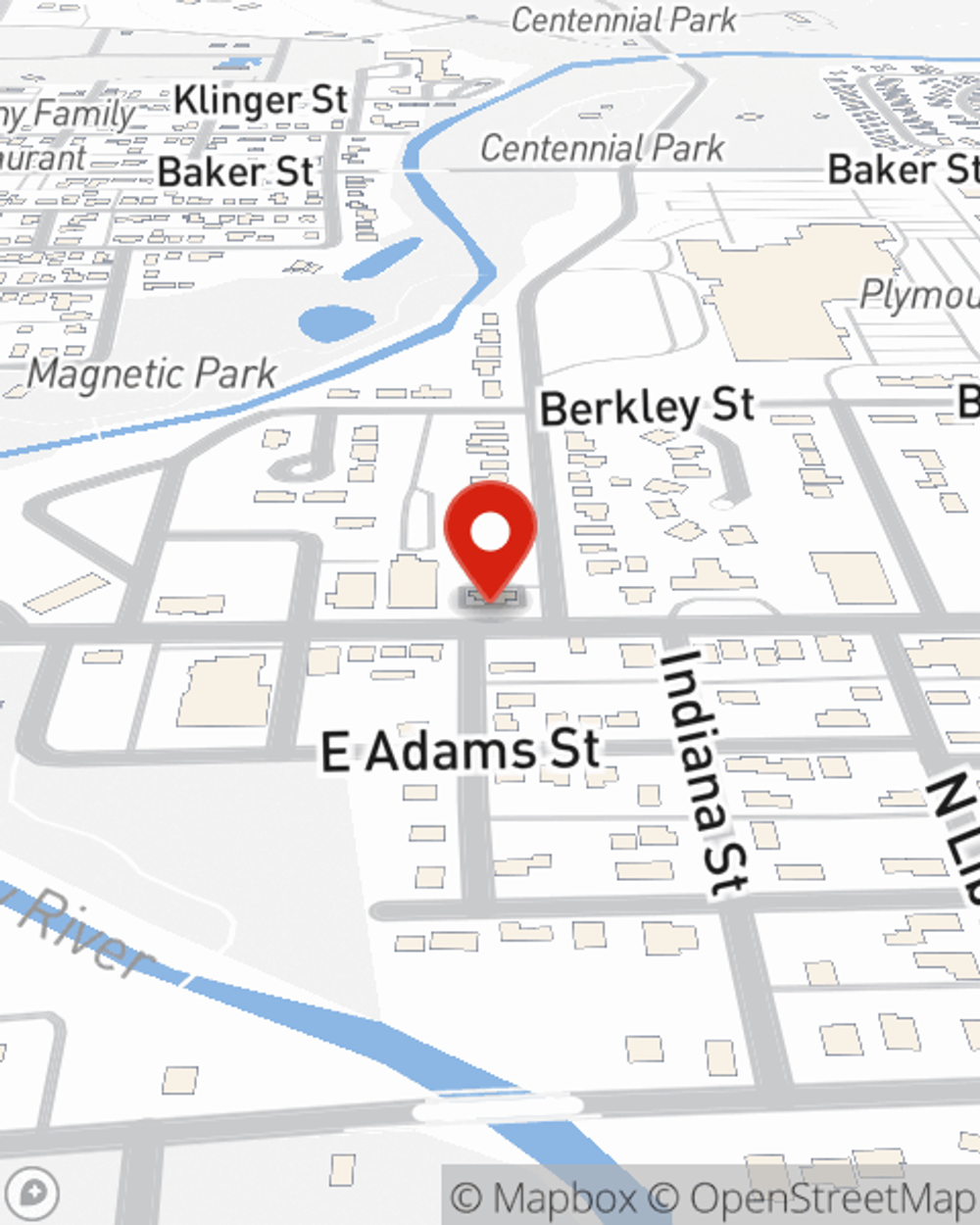

Business Insurance in and around Plymouth

Calling all small business owners of Plymouth!

Helping insure businesses can be the neighborly thing to do

Your Search For Reliable Small Business Insurance Ends Now.

Do you own a home cleaning service, cosmetic store or a toy store? You're in the right place! Finding the right insurance for you shouldn't be risky business so you can focus on making this adventure a success.

Calling all small business owners of Plymouth!

Helping insure businesses can be the neighborly thing to do

Customizable Coverage For Your Business

Each business is unique and faces a wide array of challenges. Whether you are growing a bagel shop or a clothing store, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your speciality, you may need more than just business property insurance. State Farm Agent Laurie Sutter can help with a surety or fidelity bond as well as employment practices liability insurance.

The right coverages can help keep your business safe. Consider calling or emailing State Farm agent Laurie Sutter's office today to explore your options and get started!

Simple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

Laurie Sutter

State Farm® Insurance AgentSimple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.